Cash or Card? How to take money to Switzerland

Whilst the days of carrying travellers’ cheques on an overseas trip are well behind us, it can still be hard to decide the best way to take money to Switzerland. Will a credit card be all you need? Should you get some Swiss currency before you leave? Or is there a better option?

In this article I cover the different means of making purchases whilst in Switzerland and what works best for me.

[This post may contain compensated links. Please see my disclosure policy for more information.]

But first, a bit of info about the Swiss currency.

Switzerland’s official currency is the Swiss franc but many travellers ask “Can I use Euros in Switzerland?” (or “Can I use US dollars in Switzerland?) and whilst the Euro will be accepted at some establishments, the exchange rate is likely to be unfavourable.

(US dollars are generally not accepted in Switzerland.)

Keep in mind that if you do pay in Euros, change will be given back to you in Swiss francs.

It is therefore recommended that when purchasing goods and services in Switzerland, you use the Swiss franc.

Prices are usually displayed preceded by the three-letter currency code CHF.

It’s common to ‘tap and go’ with most debit and credit cards for smaller transactions and a PIN is usually required for transactions over CHF 100.

Before you leave home, it is recommended that you advise your credit card or debit card provider that you will be travelling – and tell them where and when – so that they don’t block transactions that you try to make whilst you are abroad.

So let’s look at the different ways of carrying your spending money in Switzerland.

What's in this Article

Best payment methods in Switzerland

Credit Cards

Mastercard and Visa (and in a few establishments, American Express) credit cards are widely accepted in Switzerland and it is advisable to take a credit card with a chip in it.

It is recommended that when using a credit card to make a payment, you request that the transaction be processed in Swiss francs – not your home currency – as this way (in the majority of cases), you will benefit from a better exchange rate.

Don’t assume that your current credit card provider is giving you the best deal. Some banks and credit card providers charge fees of around 3% for international transactions and many also charge fees for withdrawing cash at an ATM.

There are credit card providers out there who have no fees (or very minimal fees) for international transactions – in Australia, Macquarie Bank, ING and 28 Degrees are a few examples.

US members of my Switzerland Travel Planning group (you can join here) have recommended the Costco and Capital One credit cards.

Check for: International transaction fees, ATM withdrawal fees, annual account fees

Debit cards

You may be wondering “Can I use my debit card in Switzerland?”

The short answer is yes but, similarly to checking that you are getting the best deal from your credit card provider, you should also check that your debit card has no fees, or very minimal fees, attached. This applies to both international card transactions and ATM withdrawals.

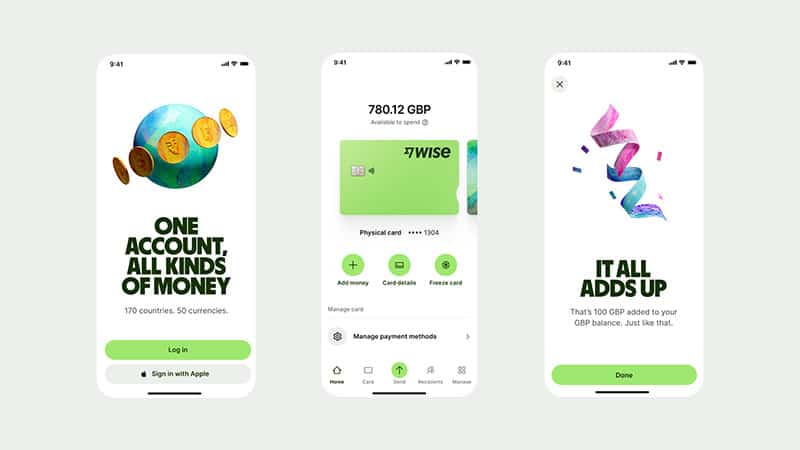

I use a Wise debit card and highly recommend it. It has no ATM fees*, no transaction fees, no monthly account fees, no minimum transactions per month and the most competitive currency exchange rates I have come across.

(*Note that when withdrawing cash from an ATM, the local bank from which you are withdrawing the cash may charge a fee, however this only happened to me once on a five week trip around Switzerland.)

Before I travel, I simply add the amount of Swiss francs I think I’ll need for my trip into my Wise account. Then it’s just a matter of ‘tap and go’ each time I need to make a payment.

Applying for an account online is simple and I also love that there’s an app so I can track my spending on the go and add more funds as needed.

(See which apps I recommend you download before you travel to Switzerland here.)

Check for: International transaction fees, ATM withdrawal fees, monthly account fees

Travel Money Card (Cash Passport)

Before obtaining my Wise debit card (mentioned above), I was a big fan of travel money cards and have used Travel Money Cards in Europe on many occasions without a problem.

I like the fact that I can preload my card with currency well before my trip if I want to, therefore purchasing the foreign currency when I’m happy with the exchange rate.

Would you like to save this article?

We promise never to spam you.

The one big disadvantage to using a travel money card in Switzerland that I encountered was that (at least, for Australians), there were no prepaid cards that allowed me to load Swiss francs.

This meant that I had to load Euros onto my card and then be charged up to as much as 6% for the privilege (?!) of having a transaction in Switzerland converted from Euros to Swiss francs.

Having already converted from my local currency when I preloaded the card, I was then hit with another conversion fee to convert from Euros to Swiss francs.

For this reason, I don’t recommend using a Travel Money Card in Switzerland – instead I use the Wise debit card which I’ve mentioned above. However, you may find a Travel Money Card that does allow you to preload Swiss francs and this may be the best option for you.

Check for: Ability to load Swiss francs onto card

Cash

A commonly asked question is ‘Do I need to carry cash in Switzerland?’

The simple answer is – in most cases – no however I believe it’s always a good idea to have a small amount of cash with you for purchases such as a coffee or ice cream or for luggage storage lockers at train stations.

In smaller villages or establishments, cards may not be accepted, and at some train stations there is a small fee (usually CHF 1) to use the public toilets*, so having some cash as a standby is also a good idea. (*Sometimes ‘tap and go’ is an option.)

Carrying a small amount of cash is also handy in times of emergency, too. Could you get by if your card was lost or stolen or there was a power loss and credit card machines were out of action?

On my recent three week trip around Switzerland, I needed cash on a few occasions including: playing a round of mini golf, buying yoghurt from a farm shop, making a donation at a local folklore show. We were also asked to pay cash at a cafe as our bill was less than CHF 20.

Some travellers prefer to buy Swiss francs prior to leaving home at a bank or foreign exchange store. This method will usually involve fees.

As I use the fee-free Wise debit card when I travel, I prefer to wait until I arrive in Switzerland and I then withdraw the amount of cash I require.

Where to exchange money in Switzerland

When it comes to money exchange, Switzerland has plenty of options.

If you are planning on getting cash in Switzerland, you’ll get the best exchange rates for foreign currency at any of the Swiss banks (they exchange bank notes only, not coins).

You can also exchange foreign notes at currency exchange desks at the major airports, railway stations and some hotels but service fees may be charged.

Planning a trip to Switzerland?

At Holidays to Switzerland we are passionate about sharing our love of Switzerland and helping you to plan the perfect trip. Read our guide to planning a trip to Switzerland to kick start your travel plans and join our free Switzerland Travel Planning group on Facebook to chat with other past and future travellers.

Want monthly news and podcast updates, helpful travel tips and special deals sent straight to your inbox? Subscribe to Holidays to Switzerland and we’ll send you a bonus copy of our 21 Useful Things to Know Before You Visit Switzerland guide.

🇨🇭 Check out our exclusive discount offers and save on your Swiss vacation. 🇨🇭

About the Swiss franc

What money do they use in Switzerland?

Now that you’ve read this article, you’ll know that the money in Switzerland is called the Swiss franc.

The Swiss franc is a decimal currency and it comes in the following denominations:

Coins – 5, 10, 20, 50 Cents and 1, 2, 5 Francs

Bank notes – 10, 20, 50, 100, 200, 1000 Francs

Final Thoughts

Without a doubt my preferred method of payment in Switzerland is with the Wise debit card. I always carry some cash for minor incidentals or emergencies, but 99% of the time I make all my payments with my card.